MIAMI — Martin County condo transactions increased year-over-year in October 2024, according to statistics released by the MIAMI Association of Realtors (MIAMI) and the MIAMI Southeast Florida Multiple Listing Service (SEFMLS).

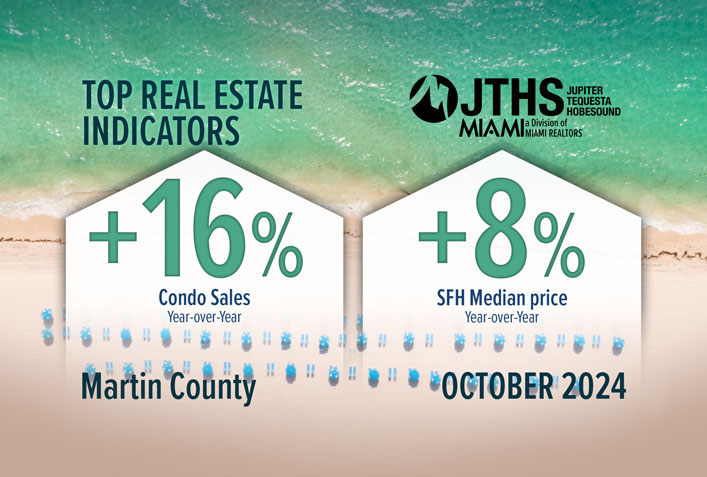

Martin condo transactions jumped 16.4% year-over-year in October 2024, from 67 to 78.

“Stuart and Martin County are celebrated for their small-town charm, world-class golf courses, excellent fishing, and stunning beaches,” said JTHS-MIAMI President Courtney Smitheman. “The city provides the perfect balance of relaxed coastal living with easy connectivity to South Florida, access to three major airports, and local private aviation travel through Witham Field.”

Martin County Single-Family Home Prices Rise

Martin County single-family home median sale prices increased 7.5% year-over-year in October 2024, increasing from $572,000 to $615,000.

Existing condo median prices decreased 6.8% year-over-year in October 2024, from $295,000 to $275,000.

Miami Again Ranks No. 1 in the Nation in Home Price Appreciation in November 2024

Miami continues to rank No. 1 in the U.S. in home price appreciation, according to the Core Logic US Home Price Insights November 2024

Miami’s home equity gains are nearly two times the national figure. Home equity gains on a single-family home purchased in Q1 2009 and sold in Q1 2024 are: Miami-Dade County at $533,955 versus the U.S. average at $287,111, according to MIAMI REALTORS® analysis assuming 10% downpayment

Florida’s Live Local Act, which was passed in 2023 and amended in May 2024, is encouraging developers to build more affordable housing. The Live Local Act gives developers the highest density allowed in a local area if they allocate 40% of its units for affordable housing. The state law defines an affordable unit as being at or below 120% of an area’s median income.

Despite the increase in prices, Miami remains a value in comparison to other global cities. In Miami, $1M nets you at least 60 square meters of prime property, according to the 2024 Knight Frank The Wealth Report. This is much higher than other global cities: Sydney, Australia ($1M only purchases 43 square meters), Shanghai (42), Paris (40), Los Angeles (38), New York (34), Geneva (34), London (33), Singapore (32), Hong Kong (22) and Monaco (16).

Martin County Single-Family Home Sales Declined

Martin County single-family home sales decreased 16.3% year-over-year, from 160 to 134.

Martin County total sales decreased 6.6% year-over-year, from 227 to 212. The decline is due to a 1% recent rise to push mortgage rates north of 7%, uncertainty of the presidential election, lack of inventory at key price points and more.

Martin County Condo Sales Rise

Martin County total existing condo sales increased 16.4% year-over-year in October 2024, from 67 to 78.

The lack of Federal Housing Administration loans for a large number of existing Miami condominium buildings is preventing further market strengthening. Of the 2,374 condominium buildings in Miami-Dade, Broward and Palm Beach counties, only 23 are approved for FHA loans, according to statistics from the U.S. Department of Housing and Urban Development.

Just 0.9% of South Florida condo buildings are approved for FHA loans.

Mortgage Rates Stay Elevated Despite Fed Cut

Mortgage rates have increased since the Fed’s first rate cut in four years in September. Rates were at 7.08% this week.

“With mortgage rates remaining elevated, wealthy buyers continue to drive Southeast Florida’s market growth, with a phenomenal increase in the market share of million-dollar homes since the pandemic,” MIAMI REALTORS® Chief Economist Gay Cororaton said. “However, the area’s strong job growth and the marked presence of wealthy buyers have continued to bolster prices. As we head into 2025, I now expect to see mortgage rates hovering at over 6% in 2025 given rising inflation expectations, but the presence of wealthier buyers should make this marker more resilient to higher mortgage rates.”

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.78% as of November 14. That’s down from 6.79% one week ago and 7.44% one year ago.

Martin County Condo Active Listings Below Historical Average

Total active listings at the end of September increased 48.8% year-over-year, from 912 to 1,357.

Inventory of single-family homes increased 43.1% year-over-year in October 2024 from 536 active listings last year to 767 last month.

Condominium inventory increased 56.9% year-over-year from 376 to 590 listings during the same period in 2023.

Months’ supply of inventory for single-family homes is 4.8 months, which indicates a seller’s market. Inventory for existing condominiums is 7.3 months, which also indicates a seller’s market. A balanced market between buyers and sellers offers between six- and nine-months supply.

Nationally, total housing inventory registered at the end of October was 1.37 million units, up 0.7% from September and 19.1% from one year ago (1.15 million). Unsold inventory sits at a 4.2-month supply at the current sales pace, down from 4.3 months in September but up from 3.6 months in October 2023.

Migration Bolstered South Florida’s Household Income by $10 Billion

Migration bolstered Southeast Florida’s aggregate household income by at least $10 billion in 2022, according to the latest most available Internal Revenue Service migration data after a new Miami Association of REALTORS® (MIAMI) analysis.

In Miami-Dade County, the average adjusted gross income of households who moved to the county (total adjusted gross income of movers divided by number of tax returns) was $175,600, which is 78% higher than the average income of households who left the county ($98,800) and 79% higher than the income of households who lived in the same county ($98,100).

Miami ranks No. 1 in the U.S. in luxury residential market price growth, via Knight Frank’s 2024 Wealth Report. The same publication also ranked Miami among the Emerging Wealth Hubs. Miami is also ranked the No. 4 U.S. City for Millionaire Growth Rate over the Past Decade (75% increase), according to Henley & Partners and New World Wealth 2024 report.

Martin County Real Estate Posts $26 Million Local Economic Impact in October 2024

Every time a home is sold it impacts the economy: income generated from real estate industries (commissions, fees and moving expenses), expenditures related to home purchase (furniture and remodeling expenses), multiplier of housing related expenditures (income earned as a result of a home sale is re-circulated into the economy) and new construction (additional home sales induce added home production).

The total economic impact of a typical Florida home sale is $123,000, according to NAR. Martin County sold 212 homes in October 2024 for a local economic impact of $26 million.

Martin County total dollar volume totaled $152 million in October 2024. Single-family home dollar volume increased 0.17% year-over-year to $128 million. Condo dollar volume decreased 13.29% year-over-year to $23 million.

Martin County Distressed Sales Remain Low, Reflecting Healthy Market

Only 0% of all closed residential sales in Martin County were distressed last month, including REO (bank-owned properties) and short sales, equal to October 2023.

Short sales and REOs accounted for 0% and 0% year-over-year, respectively, of total Martin County sales in October 2024.

Martin County’s percentage of distressed sales less than the national figure. Nationally, distressed sales represented 2% of sales in October 2024, virtually unchanged from last month and the prior year.

State and National Statistics

In Florida, closed sales of single-family homes statewide totaled 18,617 in October 2024, down 15.6% year-over-year, while existing condo-townhouse sales totaled 6,499, down 19.9%. Closed sales may occur from 30- to 90-plus days after sales contracts are written.

Nationally, total existing-home sales completed transactions that include single-family homes, townhomes, condominiums and co-ops – expanded 3.4% from September to a seasonally adjusted annual rate of 3.96 million in October. Year-over-year, sales progressed 2.9% (up from 3.85 million in October 2023).

The statewide median sales price for single-family existing homes was $415,000, up 1.2% from the previous year, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations. Last month’s statewide median price for condo-townhouse units was $315,000, down 2.2% vs. last year. The median is the midpoint; half the homes sold for more, half for less.

Nationally, the median existing-home price for all housing types in October was $407,200, up 4.0% from one year ago ($391,600). All four U.S. regions registered price increases.

Martin County Real Estate Attracting Near List Price

The median percent of original list price received for single-family homes was 94.6% in October 2024. The median percent of original list price received for existing condominiums was 92.5%.

The median number of days between listing and contract dates for Martin County single-family home sales was 59 days, up from 29 days last year. The median time to sale for single-family homes was 102 days, down from 70 days last year.

The median number of days between the listing date and contract date for condos was 53 days, up from 36 days. The median number of days to sale for condos was 99 days, up from 73 days.

Martin County Cash Sales Nearly 2X National Figure

Cash sales represented 48.5% of Martin County closed sales in September 2024, compared to 51.9% in October 2023. About 27% of U.S. home sales are made in cash, according to the latest NAR statistics.

Cash buyers are not deterred by rising rates. The high percentage of cash buyers reflects South Florida’s top position as the preeminent American real estate market for foreign buyers, who tend to purchase with all cash as well as some moving from more expensive U.S. markets who can buy more with their profits from real estate sales.

Cash sales accounted for 51.2% of all Martin County existing condo sales and 47% of single-family transactions.

To access October 2024 Martin County Statistical Reports, visit http://www.SFMarketIntel.com

Note: Statistics in this news release may vary depending on reporting dates. MIAMI reports exact statistics directly from its MLS system.

About the MIAMI Association of Realtors®

The MIAMI Association of Realtors (MIAMI) was chartered by the National Association of Realtors in 1920 and is celebrating 104 years of service to Realtors, the buying and selling public, and the communities in South Florida. Comprised of six organizations: MIAMI RESIDENTIAL, MIAMI COMMERCIAL; BROWARD-MIAMI, a division of MIAMI Realtors; JTHS-MIAMI, a division of MIAMI Realtors in the Jupiter-Tequesta-Hobe Sound area; MIAMI YPN, our Young Professionals Network Council; and the award-winning MIAMI Global Council. MIAMI REALTORS represents 60,000 total real estate professionals in all aspects of real estate sales, marketing, and brokerage. It is the largest local Realtor association in the U.S. and has official partnerships with 279 international organizations worldwide. MIAMI’s official website is www.MiamiRealtors.com

###