By Gay Cororaton, Chief Economist

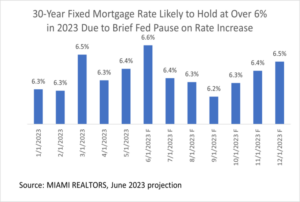

Expect a busier summer market with the Fed’s brief pause on its rate hikes before it starts to raise rates again later in the year. Mortgage rates are likely to inch downwards through September to the low 6% but will tend to rise again in October as the FOMC resumes its rate hikes to continue to bring inflation back to 2%. I expect mortgage rates to head upwards to 6.5% in December as the Fed resumes the rate hikes in October.[1]

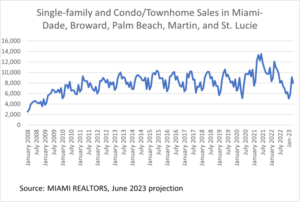

In South Florida, sales start to seasonally decline from June through September, but with mortgage rates declining to the low 6%, this will tend to raise demand and offset somewhat the seasonal decline in sales. On average during the years 2012-2019, the total existing home sales of single-family homes and condominium/townhomes in Miami-Dade, Broward, Palm Beach, Martin, and St. Lucie in September are 18% lower than the sales in June.

At the conclusion of the June 13-14 meeting, Chair Powell indicated that future rate hikes are not off the table, with the median projection of the appropriate federal funds rate target at 5.6% by the end of the year among FOMC participants, which translates to two 0.25% rate hikes. The June projection is higher than the March projection of 5.1%.

Inflation Pressures are On the Wane, Increasing Likelihood Fed Will Pause Hikes in June and September

For now, the major sources of inflation—rent, wages, supply bottlenecks, oil prices—are cooling, so I anticipate that the Fed will continue to pause the rate hikes through July and September. This will also give the FOMC time to assess the lagged impact of monetary policy on inflation and on economic activity (consumer spending, investment spending including housing and commercial real estate).

- Asking rent growth is tapering after a pandemic-related surge

The asking rent is a leading indicator of the in-place rent that is captured in the inflation estimate. According to Yardi, the average U.S. multifamily asking rent is up 2.6% year-over-year compared to 13.9% year-over-year one year ago.

In South Florida, asking rents are starting to come down after a post-pandemic surge. In Miami-Dade County, data from Rental Beast.com and MIAMI Realtors® data shows that the median asking rent on a 2-bedroom unit has climbed down from $4,200 in May 2022 to $3,800 this year, although the asking rent is still up 79% higher than the pre-pandemic level in May 2019. In Broward, the median asking rent on a 2-bedroom unit has eased to $2,401 from $2,618 one year ago, but up 59% from the level in May 2019[2].

- Wage growth is slowing

As of May 2023, the average weekly wage rose 3.4% nationally. Wage growth has slowed from 4.6% in May last year. However, wage growth is still a little bit above the average 3% monthly annual increase in 2019.

The labor market is still tight, 1.8 job openings for every unemployed worker. The ratio slightly ticked up after hovering at 1.7 in February and March. This is also still higher than the 1.2 ratio in 2019. The labor market is the main source of inflationary pressure.

- Supply chain issues are broadly back to normal

The manufacturing and distribution supply bottlenecks that disrupt production and distribution of raw materials during the COVID-pandemic are practically non-existent. One indicator of the supply chain disruption is the ratio of manufacturer’s unfilled orders to goods shipped. That ratio sharply spiked to 7.89 in April 2020 at the height of the COVID from 6.7 in the prior month. As of April 2023, the ratio is back at the pre-pandemic level .

The major ongoing disruption is at the West Coast ports amid the ongoing contract negotiations between the Pacific Maritime Association (organization of maritime companies) and the International a Longshoremen and Warehouse Union (longshoremen union) after the contract expired on July 1, 2022. However, manufacturers and other shippers are reportedly shipping cargo to Atlantic and Gulf coast ports.[3]

Worries about a global slowdown are putting a lid on oil prices despite the cut in oil production by OPEC and Russia. As of June 15, the WTI was trading slightly below $70/barrel. One year ago, the WTI was at $115/barrel. Saudi Arabia will cut oil production by 1 million barrels per day starting in July. OPEC countries announced cuts in crude oil production through the end of 2024. Global oil production is at about 100 million barrels per day. OPEC accounts about 40% of the world’s crude oil.[4]

[1] Back in January, I had expected the mortgage rate to hit 5.5% by year-end, but the regional banking distress in March and the ensuing credit tightening put upward pressure on mortgage rates. Due to a tighter labor market and sustained above-trend wage growth, the FOMC median federal funds rate projection by December has also increased to 5.6% from 5.1% in the March 2023 meeting as reported in the Summary of Economic Projections.

[2] Apartment Rent Growth Cools but Miami is Still Outpacing U.S. Rent Growth – MIAMI REALTORS®

[3] West Coast dockworkers disrupt trade for a fourth day, says maritime group | CNN Business

[4] Saudi Arabia cuts oil production again amid economic uncertainty : NPR