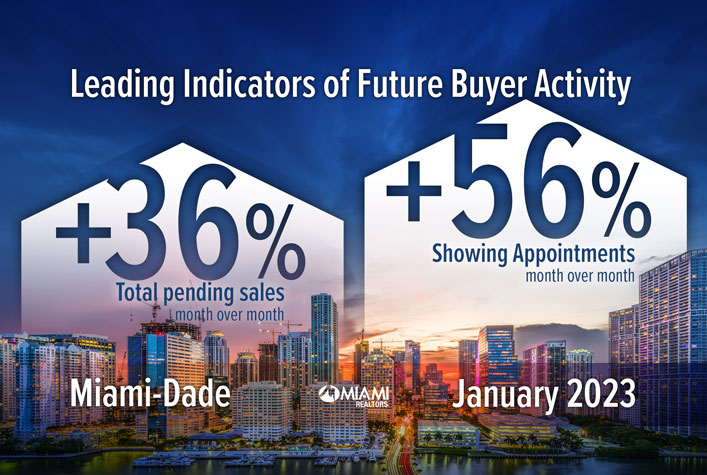

MIAMI — Two leading homebuying indicators – pending home sales and showing appointments— surged month over month in Miami-Dade County as the resilient South Florida market continues to illustrate its unique market demand in the face of elevated mortgage rates, according to January 2023 statistics released today by the MIAMI Association of Realtors (MIAMI) and the Multiple Listing Service (MLS) system.

Miami real estate, which posted its second-most total home sales in history in 2022 despite mortgage rates more than doubling over the course of the year, can expect to see more closed sales over the next coming months. It takes up to 40 days for pending sales to close and not all pending sales and showing appointments end in deals.

“Miami is a unique market because of our high percentage of cash buyers, surging migration and soaring number of international and domestic buyers,” MIAMI Chairman of the Board Ines Hegedus-Garcia said. “Miami is shielded in a sense from interest rate hikes because of those fundamentals. While other major U.S. markets are seeing decreasing prices, the Miami market is still very strong and still appreciating.”

Most South Florida Showing Appointments in a Month Since May 2022

Showing appointments in the Southeast Florida MLS, which is owned by MIAMI REALTORS®, jumped 54.5% month over month to 233,144 showings. It marks the most showings in a month since May 2022 (245,225 appointments).

Miami-Dade County total pending sales rose 35.5% month over month, from 1,688 in December 2022 to 2,288 in January 2023. It is the first month-over-month rise of total pending sales since August 2022.

Homebuyers jumped off the sidelines in January as mortgage rates decreased 1 percent point from the October high of 7.16%, but now in February rates have risen again. According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage averaged 6.32% as of February 16. That’s up from 6.12% from the previous week and 3.92% one year ago.

“While homebuyers continue to be challenged by rising mortgage rates, it’s important to note that South Florida is still in a seller’s market,” MIAMI REALTORS® Chief Economist Gay Cororaton said. “Homes are in short supply as the area continues to see stronger job growth than nationally and sustained migration, especially from retirees and relocating workers and companies. Homebuyers should take into consideration that home prices are more likely to keep rising than to decline given the shortage of homes on the market and the decline in new home construction.”

Miami January 2023 total sales decreased 46.9% year-over-year, from 2,645 to 1,402, because it’s in comparison to a historic January 2022 and the current market has lower inventory in specific price points and higher rates. Expanding the scope to analyze all Januarys shows the January 2023 total is in line with pre-pandemic numbers.

Single-family home sales decreased 41.2% year-over-year, from 1,008 in January 2022 to 593 in January 2023 because of its comparison to a historic January 2022 and the current market has lower inventory in specific price points and higher rates. Miami existing condo sales decreased 50.6% year-over-year, from 1,637 in January 2022 to 809 in January 2023, due to lack of inventory and rising mortgage rates.

Miami Real Estate’s Market Fundamentals Lead the Nation

Price Appreciation

- Miami prices keep rising (11+ consecutive years of price appreciation) unlike many other major markets and homes keep selling fast (39 days on average).

- Miami is 1 of only 2 U.S. markets forecasted to see price appreciation in 2023 according to Goldman Sachs forecast.

Migration Gains

- South Florida ranked No. 1 in the U.S. for most inbound population gains between 2019 and 2022, a 56.2% increase via United States Postal Service change-of-address data.

- South Florida out-of-state driver license exchanges remain up double digits for relocating New Yorkers, Californians, New Jerseyans and more, according to Florida Department of Highway Safety and Motor Vehicles (FLHSMV) data.

- Florida is fastest-growing state for the first time since 1957 (1,142 net new residents per day in 2022 per U.S. Census)

Cash Buyers

- Miami’s percentage of cash buyers (43.2%) is significantly higher than the national average (29%). Nearly 60% of Miami-Dade luxury buyers pay all-cash.

Wealth Influx

- Broward County and Miami-Dade County ranked No. 1 and No. 2, respectively, in the U.S. for $10M+ sales volume on basis of percentage change from 2019 vs 2022 via Compass

- Global companies continue relocating to Miami, such as Citadel, a multinational hedge fund that manages $57 billion in assets and is developing a $1 billion Miami office tower with plans to have 1,500 employees in 10 years.

Job Growth

- Miami ranked in top-20 in the U.S. for most tech job postings via CompTIA Tech Jobs Report. Tech industry offers some of the highest-paying jobs.

- About 60 companies expanded or relocated to Miami-Dade County in 2021-22, creating 8,000 new direct and indirect high-value jobs with average salary of $97,000, according to Beacon Council.

- South Florida has one of the strongest job markets in the country, with 2% unemployment– lower than the national figure.

Teleworking and Coworking

- Nicknamed the Coworking Capital of the World, Miami saw a 143% increase in demand for flexible office space in 2022 vs. pre-pandemic via The Instant Group.

- Expansion of remote work benefits Miami because if you can work wherever why wouldn’t you want to live in sunny Miami?

Global Buyers

- Miami is the No. 1 U.S. market for global buyers. Foreign homebuyers purchased $6.8 billion of South Florida residential properties in 2022, up 34% from $5.1 billion in 2021, according to our 2022 MIAMI REALTORS® Global Study.

South Florida Home Prices, Household Income Rise with Wealth Migration

Miami-Dade County single-family home median prices increased 4.8% year-over-year in January 2023, increasing from $520,000 to $545,000. Miami single-family median prices have risen for 134 consecutive months (11+ years), the longest running-streak on record. Existing condo median prices increased 11.1% year-over-year, from $360,000 to $400,000. Condo median prices have increased in 135 of the last 140 months.

While local median prices have increased so have local household incomes. Miami and West Palm Beach rank in the top-10 in the U.S. in median homebuyer growth (2019 vs 2021). Miami median homebuyer income grew 16.9% to $104,000 in 2021, and West Palm Beach median homebuyer income is $110,000 via Redfin report.

Home prices are determined by supply and demand. Lower supply and higher demand create higher prices. Inventory for Miami single-family homes (4 months) and condos (4.4 months) are low. Also, one of the supports for home prices is rents and rents are up.

Miami-Dade Active Listings Still Near Historical Lows; More Supply Needed

The average year-end Miami annual active inventory since 2008 is 19,537 and active listings at the end of 2022 totaled 10,730. Miami active listings are down 48.7% versus pre-pandemic (year-end 2022 vs. year-end 2019).

Total active listings at the end of January 2023 increased 30.1% year-over-year, from 8,275 to 10,769.

Inventory of single-family homes increased 67.5% year-over-year in January 2023 from 2,367 active listings last year to 3,964 last month. Condominium inventory increased 15.2% year-over-year to 6,805 from 5,908 listings during the same period in 2022.

New listings of Miami single-family homes decreased 6.8% to 1,306 from 1,401 year-over-year. New listings of condominiums decreased 19.6%, from 2,410 to 1,938 year-over-year.

New listings for all Miami properties are up 39.8% month over month in January 2023.

Months’ supply of inventory for single-family homes increased 122.2% to 4 months year-over-year, which indicates a seller’s market. Inventory for existing condominiums increased 51.7% to 4.4 months, which also indicates a seller’s market. A balanced market between buyers and sellers offers between six- and nine-months supply.

Nationally, total housing inventory at the end of January was 980,000 units, up 2.1% from December and 15.3% from one year ago (850,000). Unsold inventory sits at a 2.9-month supply at the current sales pace, unchanged from December but up from 1.6 months in January 2022.

Miami Real Estate Posts $157.7 Million Local Economic Impact in January 2023

Every time a home is sold it impacts the economy: income generated from real estate industries (commissions, fees and moving expenses), expenditures related to home purchase (furniture and remodeling expenses), multiplier of housing related expenditures (income earned as a result of a home sale is re-circulated into the economy) and new construction (additional home sales induce added home production).

The total economic impact of a typical Florida home sale is $112,500, according to NAR. Miami-Dade County sold 1,402 homes in January 2023 and had a local economic impact of $157.7 million.

Miami total dollar volume totaled $1.2 billion in January 2023. Single-family home dollar volume decreased 42.6% year-over-year to $588.9 million. Condo dollar volume decreased 48.1% year-over-year to $540.5 million.

Miami Distressed Sales Remain Low, Reflecting Healthy Market

Only 1.8% of all closed residential sales in Miami were distressed last month, including REO (bank-owned properties) and short sales, compared to 1.2% in January 2022. In 2009, distressed sales comprised 70% of Miami sales.

Short sales and REOs accounted for 0.5% and 1.3% year-over-year, respectively, of total Miami sales in January 2023.

Miami’s percentage of distressed sales are on par with the national figure. Nationally, distressed sales represented approximately 1% of sales in January, identical to one year ago.

Nearly 40% of all Florida Condo Sales Happened in South Florida in January 2023

South Florida (Miami, Broward, Palm Beach) registered 39.1% of all condo sales in Florida in January 2023. For all properties, South Florida had 28.4% of all sales in Florida.

In Florida, closed sales of single-family homes statewide totaled 14,766 in January 2023, down 32.5% year-over-year, while existing condo-townhouse sales totaled 6,078, down 40.7%. Closed sales may occur from 30- to 90-plus days after sales contracts are written.

Nationally, total existing-home sales transactions slid 0.7% from December 2022 to a seasonally adjusted annual rate of 4.00 million in January. Year-over-year, sales retreated 36.9% (down from 6.34 million in January 2022).

The statewide median sales price for single-family existing homes was $389,990, up 4% from the previous year, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations. Last month’s statewide median price for condo-townhouse units was $310,000, up 8.8% over the year-ago figure. The median is the midpoint; half the homes sold for more, half for less.

Nationally, the median existing-home price for all housing types in January was $359,000, an increase of 1.3% from January 2022 ($354,300), as prices climbed in three out of four U.S. regions while falling in the West. This marks 131 consecutive months of year-over-year increases, the longest-running streak on record.

Miami Real Estate Attracting Near List Price

The median percent of original list price received for single-family homes was 94.6% in January 2023, down from 98.1% last year. The median percent of original list price received for existing condominiums was 95.1%, down from 97.3% last year.

The median number of days between listing and contract dates for Miami single-family home sales was 39 days, up from 24 days last year. The median time to sale for single-family homes was 85 days, up from 74 days last year.

The median number of days between the listing date and contract date for condos was 44 days, up from 40 days. The median number of days to sale for condos was 86 days, down from 87 days.

Miami Cash Sales 48.9% More than National Figure

Cash sales represented 43.2% of Miami closed sales in January 2023, compared to 40.1% in January 2022. About 29% of U.S. home sales are made in cash, according to the latest NAR statistics.

Cash buyers are not deterred by rising rates. The high percentage of cash buyers reflects Miami’s top position as the preeminent American real estate market for foreign buyers, who tend to purchase with all cash as well as some moving from more expensive U.S. markets who can buy more with their profits from real estate sales.

Cash sales accounted for 53.8% of all Miami existing condo sales and 28.7% of single-family transactions.

To access January 2023 Miami-Dade Statistical Reports, visit http://www.SFMarketIntel.com

Note: Statistics in this news release may vary depending on reporting dates. MIAMI reports exact statistics directly from its MLS system.

About the MIAMI Association of Realtors®

The MIAMI Association of Realtors (MIAMI) was chartered by the National Association of Realtors in 1920 and is celebrating 103 years of service to Realtors, the buying and selling public, and the communities in South Florida. Comprised of six organizations: MIAMI RESIDENTIAL, MIAMI COMMERCIAL; BROWARD-MIAMI, a division of MIAMI Realtors; JTHS-MIAMI, a division of MIAMI Realtors in the Jupiter-Tequesta-Hobe Sound area; MIAMI YPN, our Young Professionals Network Council; and the award-winning MIAMI Global Council. MIAMI REALTORS represents nearly 60,000 total real estate professionals in all aspects of real estate sales, marketing, and brokerage. It is the largest local Realtor association in the U.S. and has official partnerships with 242 international organizations worldwide. MIAMI has been selected to host the prestigious FIABCI World Congress on June 5-9, 2023. MIAMI’s official website is www.miamirealtors.com

###