By Gay Cororaton, MIAMI REALTORS® Chief Economist

The Miami metro area continues to post stronger job growth than the nation, according to Bureau of Labor Statistics data released Friday. This is a robust indicator for the local commercial and residential markets.

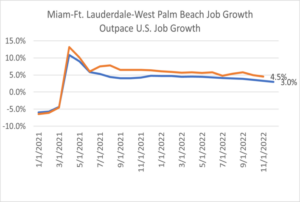

Miami metro area employment grew 4.5% (as of the latest data from November 2022) compared to 3% nationally. About 123,500 non-farm payroll jobs were created in the Miami metro area in the past 12 months as of November 2022.

South Florida’s robust business conditions, specifically because there is no state income tax except on C-corporations, have attracted workspace providers, finance, tech, legal, logistics, health companies into Miami such as Goldman Sachs, Citadel, Industrious, and Knotel. Demand for office space bodes well for MIAMI’s commercial and residential real estate markets.

Slower Wage Growth Nationally Should Temper Inflation

The national employment report released Friday is phenomenal considering that interest rates doubled in 2022 as the Fed tries to skillfully navigate the challenge of slowing inflation and keeping the economy and jobs growing.

Non-farm payroll rose at a pace faster than pre-pandemic level, up 3% year-over-year (2% pre-pandemic)

Jobs created are quality jobs, with the lower share of workers who worked part-time for economic reasons at 2.5% (3.5% pre-pandemic). Despite strong job growth, average weekly wages rose at a modest pace of 3.1% (same pace as pre-pandemic).

Slower wage growth should temper the pace of inflation. Inflation has been declining since it peaked in June, and if inflation rises at the current pace (0.2% monthly), the annual rate will fall to 2.5%-2.75% by year end, and average 3.5% in 2023.

Jobs are rising in sectors that reflect sustained pent-up consumer spending from the pandemic: leisure and hospitality (+67,000), wholesale and retail trade (+21,100), transportation and warehousing (+4,700).

However, professional and business services fell by 6,000, likely reflecting the cutback in jobs of tech companies like Twitter. However, most of the cutback (-35,000 jobs) was in the temporary help services industry subsector. This industry subsector encompasses outplacement consulting services, temporary employment, and contract staffing.

State and metro employment data as of November shows stronger job growth in Florida, at 4.7%, and in the Miami-Fort Lauderdale-West Palm Beach metro area, at 4.5%.