By Gay Cororaton, MIAMI REALTORS Chief Economist

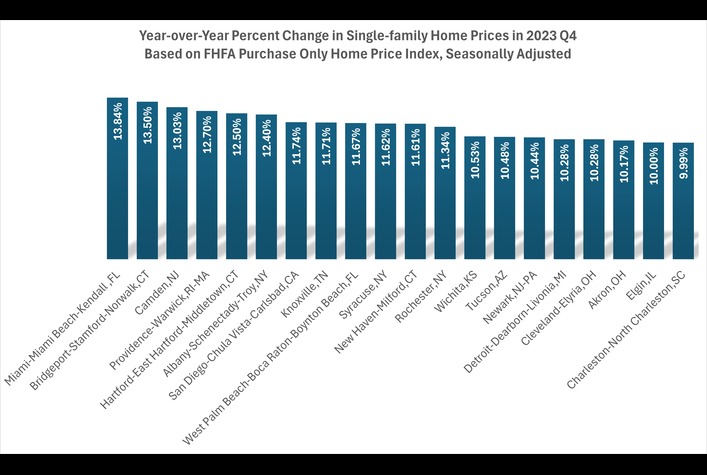

The Miami-Miami Beach-Kendall metro division closed the last quarter of 2023 with the fastest annual single-family price appreciation of 13.84% among the top 100 metro areas while the West Palm Beach-Boca Raton-Boynton Beach metro division landed 9th with prices rising 11.67%. Nationally, price rose 6.69%, with 96 out of 100 areas posting annual price appreciation, as supply remained constrained relative to demand and as mortgage rates climbed down to below 7% in the last quarter of 2023, nudging buyers back into the market.

These two areas (divisions) comprise the Miami-Ft. Lauderdale-West Palm Beach metropolitan statistical area. The price appreciation is based the FHFA Home Price Index estimated for seasonally adjusted single-family purchase-only transaction values of homes financed by Freddie Mac and Fannie Mae of repeat sales. As such, these homes will not capture purchases guaranteed by other agencies like FHA, VA, or USDA. However, inventory is very tight for homes at the lower price point of the market so the rate of appreciation could be even higher.

Meanwhile, in the city of Miami, non-seasonally adjusted single-family home prices rose 7.8% year-over-year in December 2023, according to the S&P CoreLogic Case-Shiller index that are calculated based on repeat sales from October through December 2023.

Home prices have continued to appreciate in January based on the median sales prices of homes that sold in January 2024. In January, the Miami Association of Realtors® (MIAMI) reported last week that the median single-family home sales prices rose at a faster pace than nationally (5.1%) in the counties of Miami-Dade (15.6%), Broward (6.5%), Palm Beach (5.6%) and in St. Lucie (5.9%) although home prices slightly fell in Martin (-0.7%).[1]

Among the 90 markets (municipalities and unincorporated areas) in these five counties with at least five closed sales in January, 77% of areas ( or 69 markets) saw price growths, with double-digit gains in half of these markets.[2]

Modest and Healthy Price Appreciation in 2024

I expect Southeast Florida’s single-family home prices to continue to increase at a healthy and modest pace, hovering on average at 6% in 2024.[3] Southeast Florida continues to see strong job growth[4] and sustained levels of migration above pre-pandemic levels.[5] Condo regulations, while needed to ensure the structural integrity of buildings and the safety of residents, appear to be a cause for pause among buyers in that market, pushing up the demand for single-family homes. Mortgage rates have inched up in recent weeks to nearly 7%, but as long as mortgage rates don’t go over 7% for a sustained period, demand will remain healthy as buyers have accepted the reality that mortgage rates aren’t going to dip to 3% anytime soon. Market conditions are still highly competitive, especially for homes at below $600,000 with little inventory on the market, equivalent to just 2 to 3 months of sales, so home prices are not likely to go lower in that market segment.

[2] Single-Family Home Prices Rose in 77% of Southeast Florida’s Markets, Half with Double-Digit Growths, in January 2024 – MIAMI REALTORS®

[3] Southeast Florida 2024 Outlook: Sales Rebound and Sustained Price Appreciation – MIAMI REALTORS®

[4] Miami-Dade is 4th largest job creator among 360 largest counties – MIAMI REALTORS®

[5] Southeast Florida Sees Sustained Migration in 2023 with Driver License Exchanges up 8% – MIAMI REALTORS®