By Gay Cororaton, MIAMI REALTORS Chief Economist

Home prices have been growing at a slower pace compared to the torrid pace in 2021-2022. It’s expected that the pace of price appreciation will tend to slow because of the effect of affordability on demand, with prices slowing the most in areas that seen the strongest cumulative pace of appreciation.

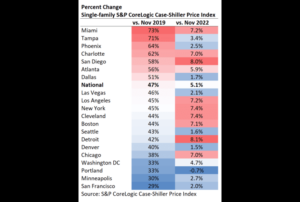

The chart below shows the pace of increase in single-family home prices based on the S&P CoreLogic Case Shiller price index since the pre-pandemic month (November 2019) and the latest y/y percent change in November 2023.

Nationally, home prices rose a total of 47% over this period, with the largest cumulative price growth in the cities of Miami (73%), Tampa (71%), Phoenix (64%), Charlotte (62%), San Diego (58%), Atlanta (56%), and Dallas (41%) among the 20 cities tracked by the S&P Index.

Of these cities with the highest cumulative gain, only the cities of Miami (7.2%), Charlotte (7.0%), San Diego (8.0%) and Atlanta (5.9%) saw a faster annual increase in November 2023 that outpaced the national y/y increase (5.1%).

Meanwhile, the pace of price growth was below the national rate in Tampa (3.4%), Phoenix (2.5%), and Dallas (1.7%).

Meanwhile, in December 2023, the median single-family home price rose 14.9% in Miami-Dade County compared to 4% nationally.

Economic Growth and Migration are Driving Demand and Price Appreciation

It is a healthy trend that home price growth is now slowing after the torrid price growth. However, prices in cities like Miami are taking time to cool down due to economic and demographic dynamics.

Job growth in Miami is outpacing the nation. In November, non-farm payroll jobs rose 3.1% in Miami-Dade County compared to 2.1% nationally.

Migration from other states remains elevated, though normalizing, compared to the pre-pandemic level, based on driver license exchanges as an indicator. Out-of-state driver license exchanges (73,068) fell 8.7% from 2022 but were 12.7% higher from 2019. New York, New Jersey, and California continue to be the top states among out-of-state driver license exchanges. Despite the slowdown in 2023, driver license exchanges remain elevated compared to pre-pandemic levels for migration from New York (+26.9%), New Jersey (+12.5%), and California (+43.2%).

Wealthy cash buyers are driving some of the price appreciation as well. In 2023, million-dollar sales accounted for about one in five sales in Palm Beach County (21.3%) and Miami-Dade County (20.3%), followed by Martin County (18.6%) and Broward County (15.4%).

The market share of million-dollar homes to total single-family home sales has surged since prior to the pandemic (2019) when the sales share was just below 10%: Miami-Dade (8.2%), Broward (4.9%), Palm Beach (7.8%), and Martin (6.5%).

Of the $1 million or more single-family sales, cash buyers also accounted for more than half of sales in Palm Beach County (68.6%) and in Martin County (67.2%) and made up slightly sales than half of sales in Miami-Dade County (47.9%) and in Broward County (43.5%).