By Gay Cororaton, Chief Economist, MIAMI REALTORS®

Mortgage rates fell for the second consecutive week to 6.42%. Rates fell following the Fed’s decision to increase the federal funds rate by a smaller increase of 0.25% at the conclusion of the March 21-22 meeting. Interest rate traders had put a higher likelihood of a 0.5% increase given the uptick in inflation in February, but the failure of two regional banks led investors to anticipate a lower rate hike, which the Fed delivered.

However, the Federal Open Market Committee press statement noted that the Fed may implement further rate hikes, noting in the press statement that “the Fed anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” The Summary of Economic Projections shows that the federal funds rate is still likely to increase to by another 0.25% from the range of 4.75% to 5.0% to a terminal rate of 5.1%, rates are likely to stay flat in the second half of the year.

Mortgage rate outlook: 5.5% by year-end as inflation wanes

While the Fed is still likely to raise rates, I expect mortgage rates to continue to generally decline in 2023 to 5.5% by year-end as inflation continues to wane. Slower rent growth and falling oil prices will be the major factors that will slow inflation. Rent data from Apartment List.com shows rents are up just 3% year-over-year nationally as of February 2023, compared to 17% year-over-year in February 2022. Oil prices (Brent) are more likely to decline or stay flat than increase due to the effect of tighter banking supervision and flight to quality assets on credit growth, investments, and overall economic growth.

Home sales expected to continue rising in through 2023

With declining mortgage rates, I expect a sustained rebound in home sales in 2023.

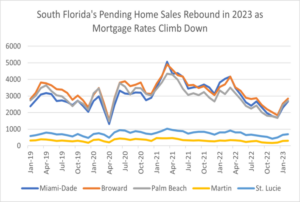

The positive effect of declining mortgage rates is already evident in the uptick in pending sales in January and February as mortgage rates climbed down to about 6.3% after touching nearly 7% in November.

Not all pending sales will end up as a closed sales (70% ratio of pending to closed sales), but pending sales typically close in 1 ½ months after the contract date, so the higher pending sales in the first two months of the year could show up in higher sales in March and April on a month-over-month basis.

Pending sales of single-family homes and condos/townhomes rose in February 2023 from the prior month in all counties. Month-over-month gains reflect seasonality effects, but February 2023’s increases outpaced the monthly change in February 2022, indicating that the rebound is more than just due to the seasonal uptick: Miami-Dade (17% in February vs. 6% one year ago), Broward (12% vs 5% one year ago), Palm Beach (11% vs. -6% one year ago), Martin (4% vs. -3% one year ago), and St; Lucie (5% vs 0% one year ago).

In Miami-Dade, pending home sales for single-family homes rose 25% in February from the prior month (vs. 5% monthly gain one year ago) while pending sales for condominiums rose 11% from the prior month (vs. 6% monthly gain one year ago).

Broward is showing the same strong recovery in pending sales. Contracts on single-family homes rose 11% in February from the prior month (vs. 3% monthly gain one year ago) while pending sales for condominiums rose 13% from the prior month (vs. 6% monthly gain one year ago).

In Palm Beach, pending home sales for single-family homes rose 14% in February from the prior month (vs. -3% one year ago) while pending sales for condominiums rose 8% from the prior month (vs. -9% one year ago).

In Martin County, contracts on single-family homes rose 14% in February from the prior month (vs. -7% one year ago) . However, contracts on condominiums fell 10% from the prior month (vs. 4% one year ago).

Pending sales rebounded across the various price points, even for $1M + homes. The share of $1M+ homes has increased sharply since 2019 in Miami-Dade, Broward, and Palm Beach where $1M homes account for about 16% to 17% of pending sales from about 6% in January 2019. More than half of sales of $1M or more homes are purchased with cash, so buyers are presumably high net worth or high income buyers who took up a larger share of the market as buyers who had to obtain a costlier mortgage pulled back.