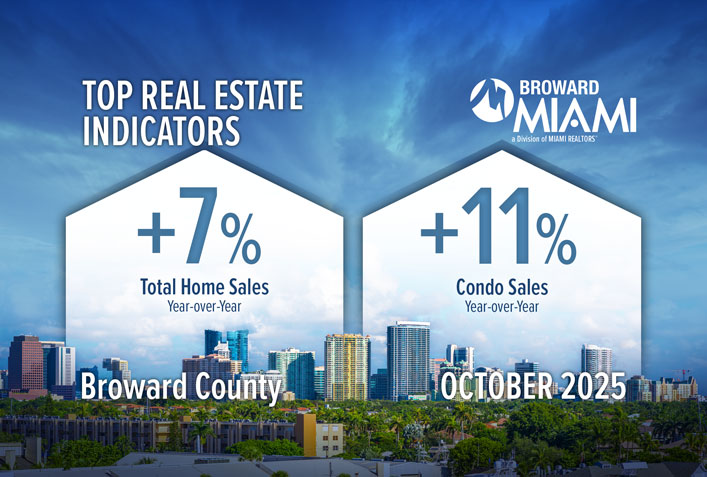

MIAMI — Broward County real estate total home sales increased year-over-year in October 2025, according to statistics released by the MIAMI Association of Realtors (MIAMI) and the MIAMI Southeast Florida Multiple Listing Service (SEFMLS).

Broward total home sales (+7%), single-family transactions (+4%) and condo sales (+11%) increased year-over-year.

“Fort Lauderdale real estate and Broward County combine quality of life, strategic location and long-term value,” Broward-MIAMI President Sophia Allen said. “The world wants to live in South Florida.”

Broward Total Sales and $1M & Up Transactions Rise

Total Broward sales increased 6.9% year-over-year in October 2025, from 1,882 to 2,011.

The sales total doesn’t include South Florida’s new construction, pre-construction and condo conversion sales because they are largely not reported in the MLS. But MIAMI led the charge to publish two new construction reports.

International buyers purchased 49% of new South Florida construction, pre-construction and condo conversion sales over an 18-month period ending in July 2025, according to MIAMI REALTORS® first-ever New Construction Global Sales Report in collaboration with industry leaders.

Our second New Construction Global Sales Report, published in November 2025, showed an increase in global sales and buyers from 73 countries, according to the MIAMI REALTORS® November 2025 Global Sales Report in collaboration with industry leaders.

Broward single-family home sales increased 3.60% year-over-year in October 2025, from 1,001 to 1,037.

Broward Condo Sales, Affordable Condos and $1M & Up Condos Sales Surge

Broward existing condo sales increased 10.56% year-over-year in October 2025, from 881 to 974.

Affordable condos— properties priced at $150,000 to $199,000— surged 14.17% year-over-year in October 2025, from 127 to 145.

$1M & up condo sales increased 6.45% in October 2025, from 31 to 33.

The lack of Federal Housing Administration loans for many existing Miami condominium buildings is preventing further market strengthening. Of the 2,397 condominium buildings in Miami-Dade, Broward and Palm Beach counties, only 21 are approved for FHA loans, according to statistics from the U.S. Department of Housing and Urban Development.

Just 0.9% of South Florida condo buildings are approved for FHA loans. Florida is the only state in the U.S. that requires a client to put down 25% for a limited review if the condo building doesn’t have enough in reserves. The requirement for every other state is 10%.

Broward Condominium Sale Prices Have Appreciated 99% in the Last 10 Years

Broward condo prices have risen 99.4% from October 2015 to October 2025, from $129,900 to $259,000.

Broward existing condo median prices decreased 7.5% year-over-year in October 2025, from $280,000 to $259,000.

Broward County single-family home median sale prices decreased 0.61% year-over-year in October 2025, from $615,000 to $611,250.

Broward single-family prices have risen 110.8% from October 2015 to October 2025, from $290,000 to $611,250.

Miami remains a bargain in comparison to other global cities. For $1M, homebuyers can purchase 58 square meters of prime property in Miami, according to the 2025 Knight Frank Wealth Report. That is almost four times more than Monaco (19 square meters), nearly two times more than New York (34) and London (34) and more than Paris, Sydney, Tokyo and more.

Miami Real Estate Home Equity & Appreciation is Nearly 2X the National Figure

Home equity is crucial for wealth building, provides a financial safety net, investment opportunities, refinancing options and more.

Miami’s home equity gains are nearly two times the national figure. Home equity gains on a Miami single-family home purchased in Q4 2009 and sold in Q4 2024 is $555,900 versus the U.S. average at $306,600, according to MIAMI REALTORS® Research.

Home equity gains on a Miami condo purchased in Q4 2009 and sold in Q4 2024 is $342,600 versus the U.S. average of $252,000.

Over the last five years, the average homeowner’s wealth has increased by $140,900, according to NAR. Research also shows a growing wealth gap between owners and renters: Based on the latest Federal Reserve Survey of Consumer Finance, NAR projected in March that homeowners’ median net worth would reach $430,000 in 2025 versus $10,000 for renters.

Florida’s Live Local Act, which was passed in 2023 and amended in May 2024, is encouraging developers to build more affordable housing. The Live Local Act gives developers the highest density allowed in a local area if they allocate 40% of its units for affordable housing. The state law defines an affordable unit as being at or below 120% of an area’s median income.

Mortgage Rates Declining

Mortgage rates, which were above 7% at the start of the year, are trending down after the first Fed rate cut of the year. According to Freddie Mac, the 30-year fixed-rate mortgage was 6.25% in October 2025.

“The strong finish this year sets up the market for a full-year growth in 2026, underpinned by several favorable tailwinds — lower mortgage rates, sustained condo market stabilization, and an expected increase in out-of-state migration, particularly from New York and California,” MIAMI REALTORS® Chief Economist Gay Cororaton said.

Broward Inventory

New listings are trending down and active listings are not growing as fast as they were at the start of the year.

Total active listings at the end of October 2025 increased 11.9% year-over-year, from 14,655 to 16,395. Homebuyers are in a great position to find the right home and negotiate for a better price.

Inventory of single-family homes increased 11.87% year-over-year in October 2025 from 4,795 active listings last year to 5,364 last month.

Condominium inventory increased 11.88% year-over-year in October 2025, from 9,860 to 11,031 listings during the same period in 2024, but the total is still significantly below pre-pandemic.

Months’ supply of inventory for single-family homes is 5.5 months, which indicates a seller’s market. Inventory for existing condominiums is 11.7 months, which indicates a buyer’s market. A balanced market between buyers and sellers offers between six- and nine-months supply.

Nationally, total housing inventory is 1.52 million units, according to NAR. That is down 0.7% from September and up 10.9% from October 2024 (1.37 million). There is 4.4-month supply of unsold inventory, down from 4.5 months in September and up from 4.1 months in October 2024.

Broward Real Estate: $259 Million in Local Economic Impact

Every time a home is sold it impacts the economy: income generated from real estate industries (commissions, fees and moving expenses), expenditures related to home purchase (furniture and remodeling expenses), multiplier of housing related expenditures (income earned as a result of a home sale is re-circulated into the economy) and new construction (additional home sales induce added home production).

The total economic impact of a typical Florida home sale is $129,000, according to NAR. Broward sold 2,011 homes in October 2025 for a local economic impact of $259 million.

Broward total dollar volume increased 3.81% year-over-year in October 2025 to $1.2 billion.

Single-family home dollar volume increased 4.03% year-over-year to $830 million. Condo dollar volume increased 4.28% year-over-year to $332 million.

Broward Distressed Sales Remain at Historic Lows, Reflecting Healthy Market

Only 1.5% of all closed residential sales in Broward were distressed last month, including REO (bank-owned properties) and short sales.

Short sales and REOs accounted for 0.1% and 1.4%, respectively, of total Broward sales in October 2025.

Nationally, distressed sales have averaged 2%.

National and State Statistics

In Florida, closed sales of single-family homes statewide totaled 21,191 in October 2025, up 13.8% year-over-year, while existing condo-townhouse sales totaled 7,223 up 11.1%.

The statewide median sales price for single-family existing homes was $411,105, even from the previous year, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations. Last month’s statewide median price for condo-townhouse units was $300,000, down 4.8% vs. last year. The median is the midpoint; half the homes sold for more, half for less.

Nationally, total existing home sales increased 1.2% year-over-year to a seasonally adjusted annual rate of 4.10 million, according to NAR. Median existing home prices increased to $415,200, up 2.1% from one year ago ($406,800) – the 28th consecutive month of year-over-year price increases.

Broward Real Estate Attracting Near List Price

The median percent of original list price received for single-family homes was 94% in October 2025. The median percent of original list price received for existing condominiums was 92%.

The median number of days between listing and contract dates for Broward single-family home sales was 55 days, up from 38 days last year. The median time to sale for single-family homes was 92 days, up from 79 days last year.

The median number of days between the listing date and contract date for condos was 77 days, up from 56 days. The median number of days to sale for condos was 115 days, up from 93 days.

Broward Cash Sales More than National Figure

Cash sales represented 37.2% of Broward closed sales in October 2025, compared to 36.9% in October 2024. About 29% of U.S. home sales are made in cash, according to the latest NAR statistics.

Cash buyers are not deterred by rising rates. The high percentage of cash buyers reflects South Florida’s top position as the preeminent American real estate market for foreign buyers, who tend to purchase with all cash as well as some moving from more expensive U.S. markets who can buy more with their profits from real estate sales.

Cash sales accounted for 51.8% of all Broward existing condo sales and 23.5% of single-family transactions.

To access October 2025 Broward Statistical Reports, visit http://www.SFMarketIntel.com

Note: Statistics in this news release may vary depending on reporting dates. MIAMI reports exact statistics directly from its MLS system.

About the MIAMI Association of REALTORS®

The MIAMI Association of REALTORS® (MIAMI) was chartered by the NATIONAL ASSOCIATION OF REALTORS® in 1920, and is celebrating 105 years of service to REALTOR® members, the buying and selling public, and the communities in South Florida. Composed of six boards: MIAMI- RESIDENTIAL, MIAMI- COMMERCIAL; BROWARD-MIAMI, a division of MIAMI REALTORS®; JTHS-MIAMI, a division of MIAMI REALTORS® in the Jupiter-Tequesta-Hobe Sound area; MIAMI YPN, our Young Professionals Network Council; and the Corporate Board of Directors. MIAMI REALTORS® represent 58,000 total real estate professionals in all aspects of real estate sales, marketing, and brokerage. It is the largest local REALTOR® association in the U.S. and has official partnerships with 298 international organizations worldwide. MIAMI’s official website is www.miamirealtors.com

###