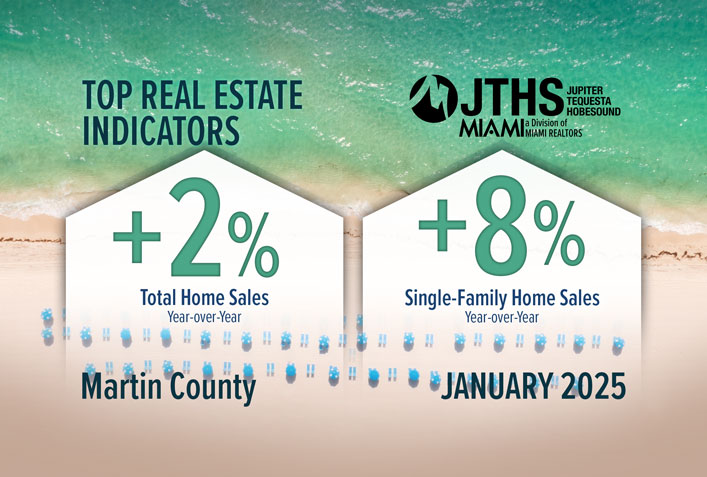

MIAMI — Martin County total home sales rose year-over-year in January 2025, according to statistics released by the MIAMI Association of Realtors (MIAMI) and the MIAMI Southeast Florida Multiple Listing Service (SEFMLS).

Martin County total home sales increased 1.8% year-over-year, from 168 to 171.

“Stuart and Martin County offers the incredible mix of a small-town charm with the proximity to one of America’s fastest growing regions,” 2025 JTHS-MIAMI President Ginenne Boehm said.

Three new rankings tell the story of South Florida’s fundamentals:

- West Palm Beach ranked No. 1 in the U.S. for Most All-Cash Sales in 2024, posting a share of 49.6% for all-cash purchases. Fort Lauderdale (38.9%) and Miami (38.1%) ranked No. 4 and No. 5, respectively, according to

- Miami-Dade County ranks No. 5 in the U.S. for most equity-rich homes with a share of 64.4%, via new data from ATTOM. Equity rich is defined as having a loan-to-value (LTV) ratio of 50% or lower.

- com ranked Miami-Fort Lauderdale-Pompano Beach, FL as the No. 2 Top Housing Market in the U.S. for 2025, forecasting a 24% year-over-year increase in sales and a 9% increase in median sale prices for 2025.

Martin County Price Appreciation

Martin County single-family home median sale prices increased 8.60% year-over-year in January 2025, increasing from $570,000 to $619,000.

Existing condo median prices decreased 17.34% year-over-year in January 2025, from $280,000 to $231,438.

South Florida Real Estate Home Equity & Appreciation is Nearly 2X the National Figure

Miami’s home equity gains are nearly two times the national figure. Home equity gains on a single-family home purchased in Q3 2009 and sold in Q3 2024 are: Miami-Dade County at $542,175 versus the U.S. average at $310,232, according to new MIAMI REALTORS® Research.

Florida’s Live Local Act, which was passed in 2023 and amended in May 2024, is encouraging developers to build more affordable housing. The Live Local Act gives developers the highest density allowed in a local area if they allocate 40% of its units for affordable housing. The state law defines an affordable unit as being at or below 120% of an area’s median income.

Despite the increase in prices, Miami remains a value in comparison to other global cities. In Miami, $1M nets you at least 60 square meters of prime property, according to the 2024 Knight Frank The Wealth Report. This is much higher than other global cities: Sydney, Australia ($1M only purchases 43 square meters), Shanghai (42), Paris (40), Los Angeles (38), New York (34), Geneva (34), London (33), Singapore (32), Hong Kong (22) and Monaco (16).

Martin County Total Home Sales Rise

Martin County total home sales increased 1.8% year-over-year, from 168 to 171.

Martin County condo transactions decreased 8.20%, from 61 to 56.

Martin County Single-Family Home Transactions Increase

Martin County single-family home transactions increased 7.5%, from 107 to 115.

The New Normal of 7% Mortgage Rates

The latest January 2025 inflation data came in higher than expected at 3% on an annual basis, making cuts by the Fed seem unlikely in the short term. Expect mortgage rates to say near 7%.

“We’re seeing the spring market off to a healthy start, with sales and prices broadly up from one year ago,” MIAMI REALTORS® Chief Economist Gay Cororaton said. “What’s driving the market is the upper price tier, with strong growth in the $600,000 and over and million-dollar market.”

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.85% as of February 20. That’s down from 6.87% one week ago and 6.90% one year ago.

Martin County Active Listings

Total active listings at the end of January 2025 increased 43.5% year-over-year, from 1,144 to 1,642.

Inventory of single-family homes increased 40.25% year-over-year in January 2025 from 636 active listings last year to 892 last month.

Condominium inventory increased 47.64% year-over-year from 508 to 750 listings during the same period in 2024.

Months’ supply of inventory for single-family homes is 5.4 months, which indicates a seller’s market. Inventory for existing condominiums is 9.2 months, which indicates a buyer’s market. A balanced market between buyers and sellers offers between six- and nine-months supply.

Nationally, total housing inventory registered at the end of January was 1.18 million units, up 3.5% from December and 16.8% from one year ago (1.01 million). Unsold inventory sits at a 3.5-month supply at the current sales pace, up from 3.2 months in December and 3.0 months in January 2024.

Martin County Total Dollar Volume Rises 25.45% Year-over-Year

Every time a home is sold it impacts the economy: income generated from real estate industries (commissions, fees and moving expenses), expenditures related to home purchase (furniture and remodeling expenses), multiplier of housing related expenditures (income earned as a result of a home sale is re-circulated into the economy) and new construction (additional home sales induce added home production).

The total economic impact of a typical Florida home sale is $129,000, according to NAR. Martin County sold 171 homes in January 2025 for a local economic impact of $22 million.

Martin County total dollar volume totaled $162 million in January 2025, up 22.56% vs. January 2024. Single-family home dollar volume increased 31.68% year-over-year to $144 million. Condo dollar volume decreased 18.96% year-over-year to $17 million.

Martin County Distressed Sales Remain Low, Reflecting Healthy Market

None of all closed residential sales in Martin County were distressed last month, including REO (bank-owned properties) and short sales, versus 0.6% in January 2024.

Short sales and REOs accounted for 0% and 0.6%, respectively, of total Martin County sales in January 2025.

Martin County’s percentage of distressed sales are less than the national figure. Nationally, distressed sales represented 3% of sales in January, virtually unchanged from December and the previous year.

National and State Statistics

In Florida, closed sales of single-family homes statewide totaled 15,384 in January 2025, up 3.6% year-over-year, while existing condo-townhouse sales totaled 5,787, down 3.7%.

Nationally, total existing-home sales completed transactions that include single-family homes, townhomes, condominiums and co-ops – descended 4.9% from December to a seasonally adjusted annual rate of 4.08 million in January. Year-over-year, sales improved 2.0% (up from 4 million in January 2024).

The statewide median sales price for single-family existing homes was $410,000, up 1.2% from the previous year, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations. Last month’s statewide median price for condo-townhouse units was $312,500, down 2.3% vs. last year. The median is the midpoint; half the homes sold for more, half for less.

Nationally, the median existing-home price for all housing types in January was $396,900, up 4.8% from one year ago ($378,600). All four U.S. regions registered price increases.

Martin County Real Estate Attracting Near List Price

The median percent of original list price received for single-family homes was 94% in January 2025. The median percent of original list price received for existing condominiums was 91%.

The median number of days between listing and contract dates for Martin County single-family home sales was 52 days, up from 50 days last year. The median time to sale for single-family homes was 92 days, up from 84 days last year.

The median number of days between the listing date and contract date for condos was 71 days, up from 45 days. The median number of days to sale for condos was 100 days, up from 86 days.

Martin County Cash Sales Nearly Double the National Figure

Cash sales represented 57.3% of Martin County closed sales in January 2025, compared to 50.6% in January 2024. About 29% of U.S. home sales are made in cash, according to the latest NAR statistics.

Cash buyers are not deterred by rising rates. The high percentage of cash buyers reflects South Florida’s top position as the preeminent American real estate market for foreign buyers, who tend to purchase with all cash as well as some moving from more expensive U.S. markets who can buy more with their profits from real estate sales.

Cash sales accounted for75% of all Martin County existing condo sales and 48.7% of single-family transactions.

To access January 2025 Martin County Statistical Reports, visit http://www.SFMarketIntel.com

Note: Statistics in this news release may vary depending on reporting dates. MIAMI reports exact statistics directly from its MLS system.

About the MIAMI Association of Realtors®

The MIAMI Association of Realtors (MIAMI) was chartered by the National Association of Realtors in 1920 and is celebrating 105 years of service to Realtors, the buying and selling public, and the communities in South Florida. Comprised of six organizations: MIAMI RESIDENTIAL, MIAMI COMMERCIAL; BROWARD-MIAMI, a division of MIAMI Realtors; JTHS-MIAMI, a division of MIAMI Realtors in the Jupiter-Tequesta-Hobe Sound area; MIAMI YPN, our Young Professionals Network Council; and the award-winning MIAMI Global Council. MIAMI REALTORS represents 60,000 total real estate professionals in all aspects of real estate sales, marketing, and brokerage. It is the largest local Realtor association in the U.S. and has official partnerships with 279 international organizations worldwide. MIAMI’s official website is www.MiamiRealtors.com

###