By Danielle Blake, Chief of Residential & Advocacy I November 27, 2024

The Federal Housing Finance Agency (FHFA) has announced a 5.21% increase in conforming loan limits for 2025, designed to keep pace with rising home prices and enhance financing accessibility for buyers nationwide. This adjustment allows borrowers to qualify for larger loans while benefiting from the advantages of conforming loans over jumbo loans, such as lower interest rates, smaller down payment requirements, and streamlined qualification processes.

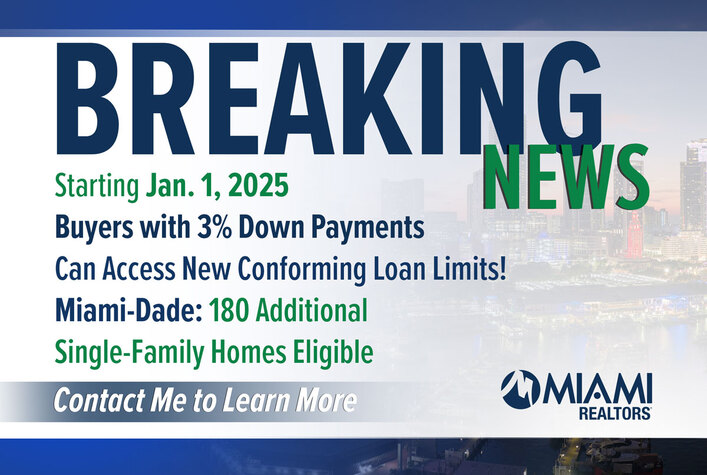

Set to take effect in 2025, the updated loan limits are expected to significantly impact high-cost markets like South Florida, where affordability challenges often coincide with strong buyer demand.

What You Need to Know as REALTOR® Members

- 2024 Confirming Loan Limit is $766,550.

- 2025 Conforming Loan Limit in $806,500.

Conforming simply means that the loan conforms to Fannie Mae and Freddie Mac lending guidelines.

Assuming buyers are putting 3% down and utilizing programs like Fannie Mae’s HomeReady or Freddie Mac’s Home Possible, the purchase price can go up to $789,546 this year and up to $830,695 next year. Currently, there are 180 active single-family homes listed for sales within this price range in Miami-Dade County on the Multiple Listing Service (MLS); 188 in Broward County and 171 in Palm Beach County.

Jumbo loans are mortgages that exceed the conforming loan limits set by the FHFA, meaning they are not eligible for purchase by Fannie Mae or Freddie Mac. These loans are designed for financing higher-value properties and typically have stricter qualification requirements due to increased risk for lenders, such as 10-20% downpayments and minimum credit scores of 700-740.

Please note that every lending situation is unique, with factors such as income, debt-to-income ratio, and financial history influencing loan terms and eligibility. The information provided here is for educational purposes and is intended to help our REALTORS® gain a clearer understanding of current market conditions and financing options. For specific lending advice, buyers should consult with a qualified mortgage professional.

Access Miami Loan Limits graphic here

Access Broward Loan Limits graphic here

Access Palm Beach County Loan Limits here