By Gay Cororaton, Chief Economist

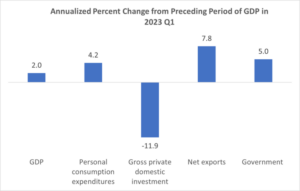

GDP rose at a much higher annualized rate of 2% in 2023 Q1 based on the third, revised from the second estimate of 1.3%. By itself, the higher GDP growth is good news, but within the context of the Fed’s fight to bring down inflation, a strong GDP growth and the persistent inflation increases the likelihood that the Federal Reserve Board Federal Open Market Committee will start raising the fed funds rate by September or October to get back to their main goal of bringing down inflation to 2%. Based on the June Summary of Economic Projections, another 50 basis points through the end of the year is deemed appropriate by the FOMC participants.

With mortgage rates likely to increase again in the fourth quarter, now is the best time to buy a home.

GDP Grows 2% in 2023 Q1 as Consumer Spending Strengthens

The upward revision was largely due to stronger personal consumer spending that rose 4.2% (3.8% 2nd estimate) and net exports (7.8% from -9.8% 2nd estimate).

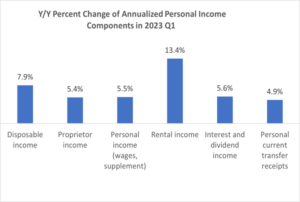

What’s holding up consumer spending? Higher disposable income that rose 7.9% on an annualized basis, a net real increase of 3.8% based on the PCE index increase of 4.1%.

Fueling the growth in disposable income is the strong growth in wages and supplemental income (5.5%), rental income (13.4%) and asset income (interest rate/dividend) income (5.6%).

Wages, rental income, and interest income are all rising as a result of the tight labor market, re-adjustment of in-place rent growth, and rising interest rates on savings accounts and financial instruments like CD’s as the Fed continues to increase the Fed funds rate.

The Personal Consumption Expenditure (PCE) Index net of food and energy spending accelerated to 4.9% in 2023 Q1 (4.1% in prior quarter) while overall PCE accelerated to 4.1% (3.7% in prior quarter). This inflation rate is still elevated relative to the Fed’s target of 2%.

The stronger PCE and consumer spending offset the much weaker investment spending of -11.9% (-8% 2nd estimate). Investment in residential structures fell 4% but investment in non-residential structures 15.8%. Investment in equipment fell 8.9% with lingering concerns that the economy could go into a recession (though short) due to the monetary tightening to control inflation.