By Gay Cororaton, Chief Economist MIAMI REALTORS®

Miami-Dade County continues to retain its real estate tax advantage against several high-cost counties in New York, New Jersey, California, and counties where major U.S. cities are located. This tax advantage is a key factor driving migration into South Florida, along with the area’s strong job growth and the shift towards remote or hybrid work that untether workers from their place of work and allow more working hours in second home vacation getaways.

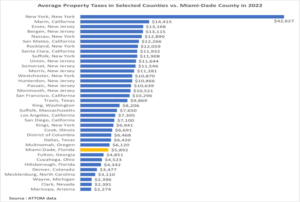

The table below compares Miami-Dade real estate taxes to the real estate taxes in counties in New York, New Jersey, and California where property real estate taxes were over $10,000 in 2022 and in major cities based on ATTOM’s report of the average property taxes paid on and the estimated value of single-family homes in 1,760 counties in 2022.[1] In addition to the counties where 20 major cities[2] are located, the table shows several New York, New Jersey, and California counties with property taxes of over $10,000 to assess Miami-Dade County’s tax competitiveness against these counties, as high property taxes are one factor driving migration out of New York, New Jersey, and California into South Florida. A MIAMI REALTORS® research[3] shows that these are the top three origins of out-of-state movers into South Florida.

In 2022, the average property tax in Miami-Dade County was $5,892, a 9.9% increase from $5,363 in 2021. It is worth noting that the average tax payment rose less than 22% increase in property values in 2022. Miami-Dade commissioners approved a millage rate cut to provide some relief to homeowners[4], bringing down the millage rate from 21.2466 in 2021 to 20.6152 in 2022.[5]

The average real property tax in Miami-Dade County in 2022 was lower than the property tax paid in six New York counties in the New York-Newark-Jersey City metropolitan area: New York, (where Manhattan is located) Nassau (where Long Island is located), Rockland, Suffolk, Westchester, and Kings (where Brooklyn is located). Except for Kings County ($6,941), the property taxes in these counties are over $10,000. However, the average property tax fell in Westchester (-20%) and Kings County (-50%) as property values rose at a modest pace of 5.9% in Westchester County and 7.9% in Kings County compared to 22.4% in Miami-Dade County. Except in New York County (0.56%) and Kings County (0.57%), the effective tax rates were higher than that of Miami-Dade (0.64%), ranging from 1.07% in Westchester to 1.48% in Nassau County.

In eight New Jersey counties, the average real property taxes remained higher in 2022 in terms of the level of the tax payment that exceeded $10,000 in 2022: Essex, Bergen, Union, Somerset, Morris, Hunterdon, Passaic, and Monmouth. The effective tax rate was also higher in these counties, ranging from 1.4% in Monmouth to 2.0% in Essex.

Miami-Dade County continues to retain a property tax advantage against the high-cost counties of the San Francisco-Oakland-Hayward metro area in California. In the three counties of San Francisco, Marin, San Mateo, and Santa Clara, the average property taxes exceeded $10,000 in 2022. Miami-Dade County also has a tax advantage against Los Angeles County and San Diego County. However, these counties saw a smaller increase in the property tax level in 2022 due to modest price growth and even a price decline in San Francisco (-4.5%).

While Miami-Dade County has a tax advantage against several New York, New Jersey, and California counties, there are several Sunbelt counties with lower property taxes than that of Miami-Dade County: Fulton County, Georgia (where Atlanta is located), Cuyahoga County, Ohio (where Cleveland is located), Denver County (where Denver is located), Mecklenburg County, North Carolina (where Charlotte is located), Wayne County, Michigan (where Detroit is located), Clark County , Nevada (where Las Vegas is located) , Maricopa County (where Phoenix is located). Hillsborough County, Florida (where Tampa is located) also has lower property taxes than Miami-Dade County. But one reason for their tax advantage is that home prices also rose at a slower pace in these counties.

In summary, despite the strong price appreciation in Miami-Dade County, it retains a tax advantage compared to the high-cost counties of New York, New Jersey, and California, and major cities. The tax advantage, particularly in counties where property tax payments are at over $10,000, will continue to encourage migration into South Florida, helping bolster residential and commercial real estate transactions.

[1] Total Property Taxes Up 4 Percent Across U.S. In 2022 | ATTOM (attomdata.com)

[2] 20 cities tracked by the Case Shiller Home Price Index

[3] Miami-Dade’s Out-of-State Homebuyers Earn Nearly $100K+ Median Household Income – MIAMI REALTORS®

[4] https://www.nbcmiami.com/news/local/miami-dade-commissioners-approve-1-property-tax-reduction/2809313/