MIAMI — Palm Beach County year-to-date total volume is higher than last year, according to June 2025 statistics released by the MIAMI Association of Realtors (MIAMI) and the MIAMI Southeast Florida Multiple Listing Service (SEFMLS).

Palm Beach County year-to-date total dollar volume is 1.84% higher than at this time last year with total dollar volume at $11.7 billion.

“Buyers from high-taxed, high-density states continue moving to South Florida and that’s evidenced by the higher total dollar volume and increase in $1M and up home sales,” 2025 JTHS-MIAMI President Ginenne Boehm said.

MIAMI REALTORS® New Construction Data Report Coming Monday, July 28

MIAMI REALTORS® will release a groundbreaking new construction international sales report on Monday, July 28. A collaborative effort between MIAMI and leading developers and brokerages, the report is the first of its kind to provide comprehensive data on new condominium sales, addressing a longstanding need and reshaping how the industry tracks international buyer activity in South Florida.

South Florida is home to one of the most robust new construction markets in the U.S. But statistics reported in MIAMI’s monthly statistical news releases don’t include South Florida’s new construction, pre-construction and condo conversion sales because they are largely not reported in the MLS.

Palm Beach County Median Prices

Palm Beach County existing condo median prices decreased 3.1% year-over-year in June 2025, from $325,000 to $315,000.

Palm Beach County single-family prices decreased 5.2% year-over-year in June 2025, from $659,999 to $626,000.

South Florida Real Estate Home Equity & Appreciation is Nearly 2X the National Figure

Home equity is crucial for wealth building, provides a financial safety net, investment opportunities, refinancing options and more.

Miami’s home equity gains are nearly two times the national figure. Home equity gains on a Miami single-family home purchased in Q4 2009 and sold in Q4 2024 is $555,900 versus the U.S. average at $306,600, according to MIAMI REALTORS® Research.

Home equity gains on a Miami condo purchased in Q4 2009 and sold in Q4 2024 is $342,600 versus the U.S. average of $252,000.

Over the last five years, the average homeowner’s wealth has increased by $140,900, according to NAR. Research also shows a growing wealth gap between owners and renters: Based on the latest Federal Reserve Survey of Consumer Finance, NAR projected in March that homeowners’ median net worth would reach $430,000 in 2025 versus $10,000 for renters.

Florida’s Live Local Act, which was passed in 2023 and amended in May 2024, is encouraging developers to build more affordable housing. The Live Local Act gives developers the highest density allowed in a local area if they allocate 40% of its units for affordable housing. The state law defines an affordable unit as being at or below 120% of an area’s median income.

Palm Beach County Total Sales

Palm Beach County total sales decreased 6% year-over-year in June 2025, from 2,137 to 2,008. The statistics would be much stronger if they included South Florida’s robust developer new construction market and volume. Macroeconomic reasons out of South Florida’s control such as elevated mortgage rates, a volatile stock market, lack of condo financing and lack of inventory at key price points are reasons for the decline.

If average mortgage rates were to decline to 6%, NAR forecasts an additional 160,000 renters becoming first-time homeowners and elevated sales activity from existing homeowners.

Palm Beach County single-family home sales decreased 6.46% year-over-year (from 1,269 to 1,187).

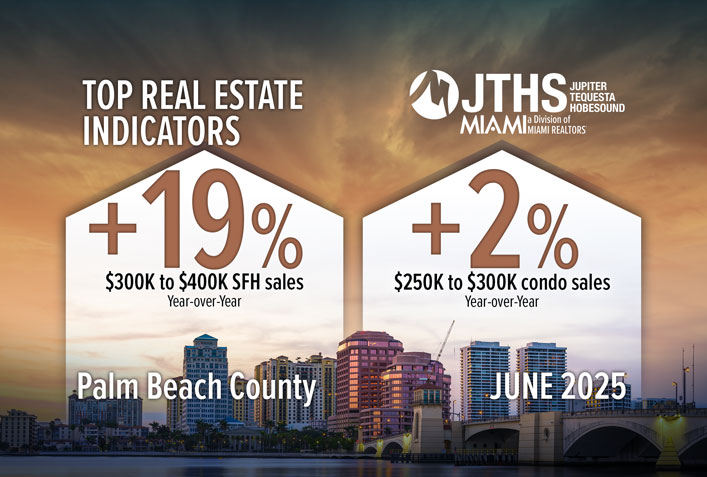

Affordable Condo Sales Up

Palm Beach County condos priced between $250K and $300K increased 2.3% year over year to 91 transactions.

Palm Beach County total existing condo sales decreased 5.41% year-over-year in June 2025, from 868 to 821. The statistics would be much stronger if they included South Florida’s robust developer new construction market and volume. The decline is due to lack of condo financing and inventory at key price points.

“Once mortgage rates start to head towards the low 6%, which I see happening in 2026, sales will pick up,” MIAMI REALTORS® Chief Economist Gay Cororaton said. “Meanwhile, the million-dollar plus sales segment continues to be a bright spot.”

The lack of Federal Housing Administration loans for a large number of existing Miami condominium buildings is preventing further market strengthening. Of the 2,397 condominium buildings in Miami-Dade, Broward and Palm Beach counties, only 21 are approved for FHA loans, according to statistics from the U.S. Department of Housing and Urban Development.

Just 0.9% of South Florida condo buildings are approved for FHA loans. Florida is the only state in the U.S. that requires a client to put down 25% for a limited review if the condo building doesn’t have enough in reserves. The requirement for every other state is 10%.

As a leader in advocacy, MIAMI REALTORS® is working with the Legislature to support our market. MIAMI brought together lawmakers, top experts and more for a sold-out Condo Summit on Feb. 14 that empowered REALTORS® with the latest knowledge and tools. MIAMI followed it up with a Capitol to Closings, 2025 legislative session breakdown on May 8, 2025.

Mortgage Rates Stay Elevated as Fed Keeps Rates Steady

The Fed is holding rates steady with concerns about inflation.

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.75% as of July 17, down from 6.77% one year ago.

Total Palm Beach County Inventory

Total active listings at the end of June 2025 increased 19.1% year-over-year, from 11,692 to 13,929. Palm Beach County condo inventory is still below pre-pandemic and new condo listings decreased in June 2025.

Inventory of single-family homes increased 21% year-over-year in June 2025 from 5,170 active listings last year to 6,259 last month.

Condominium inventory increased 17.60% year-over-year in June 2025, from 6,522 to 7,670 listings during the same period in 2024, but the total is still significantly below pre-pandemic.

Months’ supply of inventory for single-family homes is 5.7 months, which indicates a seller’s market. Inventory for existing condominiums is 9.7 months, which indicates a buyer’s market. A balanced market between buyers and sellers offers between six- and nine-months supply.

Nationally, total housing inventory registered at the end of June was 1.53 million units, up 15.9% from June 2024 (1.32 million). 4.7-month supply of unsold inventory, up from 4.6 months in May and 4 months in June 2024.

Palm Beach County Real Estate: $259 Million in Local Economic Impact

Every time a home is sold it impacts the economy: income generated from real estate industries (commissions, fees and moving expenses), expenditures related to home purchase (furniture and remodeling expenses), multiplier of housing related expenditures (income earned as a result of a home sale is re-circulated into the economy) and new construction (additional home sales induce added home production).

The total economic impact of a typical Florida home sale is $129,000, according to NAR. Palm Beach County sold 2,008 homes in June 2025 for a local economic impact of $259 million.

Palm Beach County total dollar volume decreased 7.16% year-over-year in June 2025 to $1.8 billion.

Single-family home dollar volume decreased 6.59% year-over-year to $1.4 billion. Condo dollar volume decreased 9.02% year-over-year to $420 million.

Palm Beach County Distressed Sales Remain Low, Reflecting Healthy Market

Only 0.8% of all closed residential sales in Palm Beach County were distressed last month, including REO (bank-owned properties) and short sales, versus 0.6% in June 2024.

Short sales and REOs accounted for 0.1% and 0.6%, respectively, of total Palm Beach County sales in June 2025.

Palm Beach County’s percentage of distressed sales are less than the national figure. Nationally, distressed sales represented 3% of sales in June 2025, unchanged from May and up slightly from 2% in June 2024.

Palm Beach County Price Appreciation Outperforming Nation, State

In Florida, closed sales of single-family homes statewide totaled 23,827 in June 2025, up 2.8% year-over-year, while existing condo-townhouse sales totaled 7,809, down 6.4%.

Nationally, total existing-home sales completed transactions that include single-family homes, townhomes, condominiums and co-ops – decreased 2.7% month-over-month to a seasonally adjusted annual rate of 3.93 million. No change in sales year-over-year.

The statewide median sales price for single-family existing homes was $412,000, down 3.5% from the previous year, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations. Last month’s statewide median price for condo-townhouse units was $300,000, down 7.7% vs. last year. The median is the midpoint; half the homes sold for more, half for less.

Nationally, the median existing-home price for all housing types $435,300 in June 2025, up 2% from one year ago ($426,900) — a record high for the month of June, and the 24th consecutive month of year-over-year price increases.

Palm Beach County Real Estate Attracting Near List Price

The median percent of original list price received for single-family homes was 93% in June 2025. The median percent of original list price received for existing condominiums was 91%.

The median number of days between listing and contract dates for Palm Beach County single-family home sales was 42 days, up from 35 days last year. The median time to sale for single-family homes was 88 days, up from 80 days last year.

The median number of days between the listing date and contract date for condos was 61 days, up from 46 days. The median number of days to sale for condos was 100 days, up from 89 days.

Palm Beach County Cash Sales More than National Figure

Cash sales represented 47.3% of Palm Beach County closed sales in June 2025, compared to 49.9% in June 2024. About 29% of U.S. home sales are made in cash, according to the latest NAR statistics.

Cash buyers are not deterred by rising rates. The high percentage of cash buyers reflects South Florida’s top position as the preeminent American real estate market for foreign buyers, who tend to purchase with all cash as well as some moving from more expensive U.S. markets who can buy more with their profits from real estate sales.

Cash sales accounted for 56.5% of all Palm Beach County existing condo sales and 40.9% of single-family transactions.

To access June 2025 Palm Beach County Statistical Reports, visit http://www.SFMarketIntel.com

Note: Statistics in this news release may vary depending on reporting dates. MIAMI reports exact statistics directly from its MLS system.

About the MIAMI Association of REALTORS®

The MIAMI Association of REALTORS® (MIAMI) was chartered by the NATIONAL ASSOCIATION OF REALTORS® in 1920, and is celebrating 105 years of service to REALTOR® members, the buying and selling public, and the communities in South Florida. Composed of six boards: MIAMI- RESIDENTIAL, MIAMI- COMMERCIAL; BROWARD-MIAMI, a division of MIAMI REALTORS®; JTHS-MIAMI, a division of MIAMI REALTORS® in the Jupiter-Tequesta-Hobe Sound area; MIAMI YPN, our Young Professionals Network Council; and the Corporate Board of Directors. MIAMI REALTORS® represent 58,000 total real estate professionals in all aspects of real estate sales, marketing, and brokerage. It is the largest local REALTOR® association in the U.S. and has official partnerships with 288 international organizations worldwide. MIAMI’s official website is www.miamirealtors.com

###