By MIAMI REALTORS® Chief Economist Gay Cororaton

The 30-year mortgage rate fell for the fourth consecutive week during the week of December 8, 2022 to 6.33%. The mortgage rate fell in the wake of expectations that the Fed will implement a smaller rate hike of 50 basis points in its December meeting, with inflationary pressures.

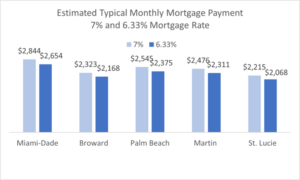

The decline in mortgage rates yields significant monthly savings of about $150 to nearly $200 based on median sales home prices as of October in South Florida, with the largest savings in Miami Dade County that has a median sales price of $475,000.

The decline in mortgage rates has already boosted investor confidence about the economy. The S&P 500 index went up about 1% within two hours after the release of the data. The Federal Open Market Committee meets on December 13-14. An announcement of the Fed’s policy on the pace and size of future rate increases and even considerations of pausing on the rate hikes will reduce the level of uncertainty about the rate hikes and the economy’s growth prospects.

With mortgage rates on the decline and normalizing in the 6% range, the pace of home sales decline will start to ease. Home sales are more likely to stay flat or expand rather than contract in 2023 nationally. The South Florida home sales market is expected to do better than nationally given the stronger labor market conditions in the Miami metro area. As of October, the unemployment rate in the Miami-Fort Lauderdale-West Palm Beach metro area was 2.3% compared to 3.7% nationally. This metro area continues to attract people from high cost and high tax markets like New York and California.